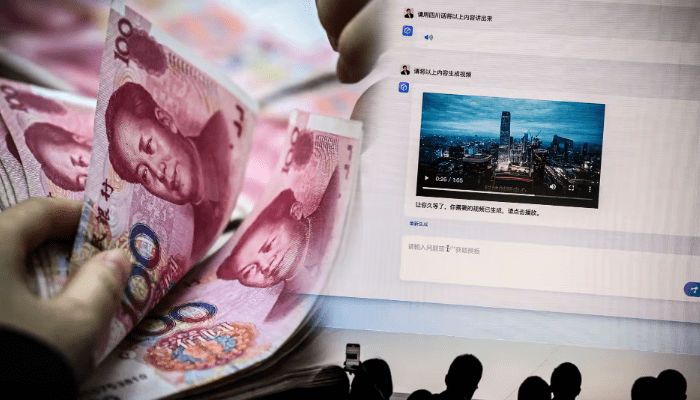

AI frenzy sweeps China as companies search for their own ChatGPT

AI frenzy sweeps China as companies search for their own ChatGPT

HONG KONG — In February, shortly after OpenAI’s ChatGPT took the tech world by storm, a series of posts by high-profile Chinese entrepreneur Wang Huiwen went viral on social media.

“I am investing $50 million. Please team up with me to embrace the new era and create China’s OpenAI. I currently do not understand AI technology but I am working hard to learn,” Wang, the co-founder of food delivery platform Meituan, said in one of the posts.

Some analysts were skeptical, pointing out that $50 million is just a drop in the ocean when it comes to the funds needed to train chatbots like ChatGPT.

Wang, however, is just one of many Chinese investors rushing to get into generative AI, and many are focusing on one particular area: large language models.

Large language models are the technology that underpins chatbots like ChatGPT and Google’s Bard. Using algorithms and advanced computing power, these models are trained on vast amounts of datasets to generate humanlike responses.

In the past three months, more than 30 Chinese entities have announced they are developing their own large language models. These include tech giants such as Alibaba, Tencent, Baidu and Huawei Technologies — which had already started before ChatGPT burst onto the scene — as well as universities, state-backed institutions and entrepreneurs new to AI, like Wang.

“Dozens of Chinese companies rushing to build foundation models is typical for any new technology with great potential. The explosion of new players and products will usually be followed by consolidation as the technology matures and clear winners emerge,” said Andy Chun, vice president of the Hong Kong Computer Society.

Already the threshold for investing in large language models in China has risen from $50 million to $100 million since the start of the year, investors told Nikkei Asia.

One reason for the rush of interest and investments is the vast commercial potential. China’s market for AI software and applications is projected to quadruple in value between 2021 and 2026 to over $21 billion dollars, according to market research firm IDC.

Another reason is the appeal of the large language model approach itself.

“Industry experts believe that we have entered a new era of large language models, and many feel that it is worth revisiting and reworking all products from scratch. Rather than using application programming interfaces (APIs) or integrating existing systems, we plan to completely rebuild and reconfigure every product,” Baidu’s co-founder and CEO Robin Li said in a speech last week.

“Large language models have transformed artificial intelligence, and they will soon transform the world,” he said.

Companies are not the only ones with their eye on AI. Given its importance to national security and global competitiveness, China’s government has introduced policies to support the AI industry and is trying to turn the country into a world leader in the field. Earlier this year, the Beijing municipal government pledged to support companies to build large language models to compete against ChatGPT.

The Chinese Communist Party has said the country will foster scientific research by focusing on fields including AI, quantum information and microchips, though it has also signaled restrictions on development. The nation’s top cyberspace watchdog has issued a proposed rule stating that content created using generative AI should reflect “socialist core values” and Chinese President Xi Jinping has also urged improvements in “the security governance of artificial intelligence.”

All of this excitement, however, does not change the fact that building large language models is costly, in both financial and environmental terms. The carbon emissions from training a single model can be as high as hundreds of tons, according to a report by Stanford University.

In the U.S., only major tech players can afford to develop large language models. OpenAI, for example, has considerable financial backing from Microsoft, which has allowed it to further develop ChatGPT.

Xiao Yanghua, a professor of computer science at Fudan University in Shanghai, said in an online post that for now many Chinese institutions are just fine-tuning open-source foundation models and using relatively cheap APIs like ChatGPT to generate data in order to “develop” their own models.

“That’s why when you ask some domestic large language models ‘Who are you?’ the answer is ‘I am ChatGPT,'” Xiao said.

He was also critical of the money being poured into AI, comparing it to Mao Zedong’s disastrous economic policy. “The current development of large language models is very much like the Great Leap Forward in the 1950s, which caused a great waste of human, material and financial resources,” he said.

Judging how much this flurry of investment has paid off so far is not easy.

“The challenge has been that these Chinese models have not been released to a broad segment of the population, so it has been difficult to evaluate how they compare with state-of-the-art models like those behind ChatGPT and Bard,” said Paul Triolo, a China and technology expert at the Albright Stonebridge consultancy.

According to Triolo, Chinese firms tend to plug their generative AI models into tightly focused verticals, or their target market, and use their own data sets to more quickly develop applications that will create revenue.

U.S. restrictions on exports of cutting-edge graphical processing units, or GPUs, will not be a major hurdle in the short term, he added, but over time it could become difficult for Chinese companies to work around these hardware limitations.

Another, more immediate, challenge for Chinese companies has to do with datasets, according to Qing Wei, chief technology officer of Microsoft China.

While the language data that ChatGPT can extract is open, shared and free, most of the high-quality Chinese language data needed to create a “Chinese version of ChatGPT” is held by companies or institutions and cannot be shared, Wei said in March.

Zeren Bai, senior principal at Shanghai-based Linear Capital, which focuses on investing in data applications and data infrastructure in China, said most Chinese internet giants are developing their own large language models, as they have the advantage of leveraging their own data.

“For big tech companies in China, it is hard for them to give data to competitors or connect with rivals’ APIs, that’s why they want to build their own models if they are ready to embrace the new AI era,” he said.

Despite the hurdles, Bai said the industry consensus since the advent of ChatGPT is that it is worth redoing all applications.

“Applications built on top of foundation models will be a relatively certain opportunity, so we are focusing on generative AI applications in industry verticals, rather than on general chat-focused platforms,” he said. Examples of this could include using AI to generate photos or videos for marketing.

And Chinese large language models are indeed evolving and improving. Take Baidu’s Ernie Bot, the first Chinese answer to ChatGPT. The bot is still undergoing testing and not yet open to the public, but Baidu recently said that Ernie’s queries per second — a measure of how much traffic it can handle — have increased by about 10 times since its limited release in March.

Meanwhile, Alibaba Cloud on Thursday introduced its intelligent assistant, Tingwu, which is based on its large language model Tongyi Qianwen. Tingwu can convert speech and videos to text in real time, and is available for public beta testing.

But Tencent and Alibaba have vast financial resources and armies of engineers at their disposal. Where does this leave the hopefuls, like entrepreneur Wang?

“Only a few tech giants will finally win in the large language models war, just as thousands of Chinese companies were burning cash for market share in the battleground of group buying in early 2010s and only a handful of them survived,” said James Chou, the managing director of Microsoft for Startups North Asia.

“I believe that there may be more innovative developments in narrow and specialized vertical industries, as some companies could leverage their expertise in a particular field and the exclusive data they possess to create new models.”

Other Interesting:

A traveler’s dream: Southeast Asian countries are connected through cashless payment systems

See other website:

Oriental Game

Article Source

https://asia.nikkei.com/Business/Business-Spotlight/AI-frenzy-sweeps-China-as-companies-search-for-their-own-ChatGPT

Other Interesting Articles

Jun 5, 2023