Osaka Integrated Resort Faces Loan Challenges: Reports

After getting approval from the government, Japan’s first planned casino resort in Osaka is projected to secure a record-breaking JPY550 billion ($4.1 billion) loan; however, some banks who were initially anticipated to participate have changed their minds.

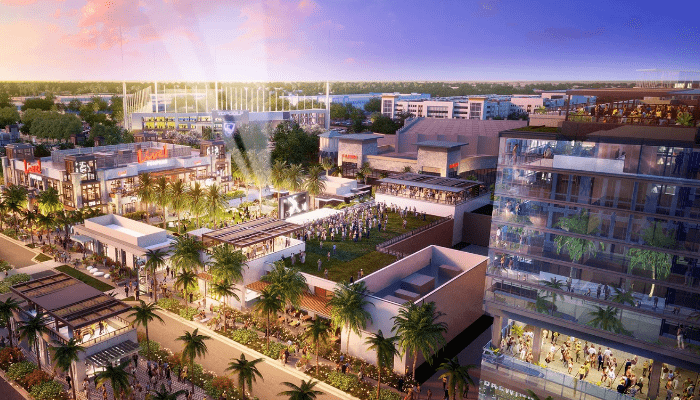

The Integrated Resort District Development Plan for Osaka was authorized in April after nearly a year of consideration by the Japanese government’s central body. The Osaka prefecture and city are moving forward with the project in coordination with private sector partners MGM Resorts and Orix, with an eye toward an opening in the fall or winter of 2029. Since then, the CEO of MGM Resorts has predicted that the project will only debut in 2030.

Major lenders have reportedly become reluctant to support the initiative as a result of the pandemic forcing casinos to close, according to Nikkei Asia. Furthermore, it has become more challenging to obtain loans due to locals’ worries about gambling addiction and public safety.

A syndicated loan is being led by Osaka-based MUFG Bank and Sumitomo Mitsui Banking Corp. Depending on how much money they can borrow from other lenders, the two are anticipated to each contribute between JPY200 billion ($1.5 billion) and JPY300 billion ($2.23 billion).

Resona Bank and SBI Shinsei Bank, two significant Japanese banks, have shown their interest in taking part in the project. The state-controlled Development Bank of Japan and Sumitomo Mitsui Trust Bank are also considering joining the organization. Additionally, in order to assemble a group of solely Japanese organizations, arrangers have contacted smaller regional banks and life insurers.

But Mizuho Bank is noticeably absent from the list of anticipated participants, according to the arrangers, and has not yet responded positively.

Mizuho’s ambivalent approach to the project reflects a difference in their lending philosophy from MUFG and SMBC. These two banks are relying on the debt to be repaid through future income under a project finance strategy. Mizuho, in contrast, has chosen a more conventional corporate finance strategy that relies on the creditworthiness of the companies.

Other lenders would have to provide the JPY100 billion ($740 million) funding gap if Mizuho started to scale back on loans.

The planned resort on Yumeshima Island has raised concerns among Mizuho and other banks about potential dangers. There is question regarding who would be accountable for paying the price should soil contamination and liquefaction turn out to be dangers. The key to choosing loan agreements is evaluating these risks and deciding who is responsible.

Article Source

http://www.yogonet.com

Other Interesting Articles

Bitcoin On-Chain Transactions Reach New Heights, What’s Fueling the Surge?

Bitcoin On-Chain Transactions Reach New Heights, What’s Fueling the Surge?May 5, 2023