Why Taxation Of Virtual Assets Doesn’t Make Them Legal

Incomes derived from even illegal activities are liable to tax, as per some current tax provisions and court precedents.

Finance Minister Nirmala Sitharaman clarified in the Rajya Sabha recently that the government’s move to levy a 30 per cent tax on gains from transactions in private digital currencies has nothing to do with their legal status. She added that the decision on “banning or not banning” cryptocurrencies will be taken after consultations.

Incomes derived from even illegal activities are liable to tax, as per some current tax provisions and court precedents.

Current Tax Provisions

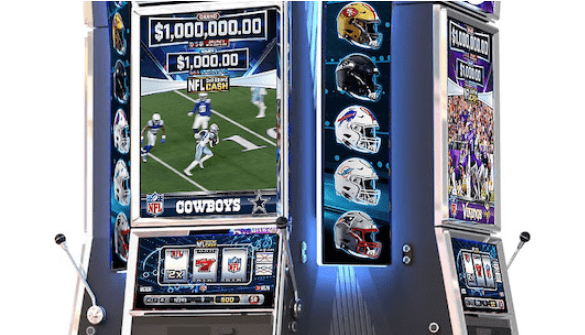

Income tax provisions for certain activities such as gambling and lottery transactions make them liable for tax.

“For gambling and betting, there is a provision for taxation as per Section 115BB of the Income-tax Act, where winnings from gambling, betting, lotteries and other (such) games are taxed at 30 per cent. This provision is there in the Income-tax Act despite gambling and betting being illegal in most states,” says Jay Sayta, technology lawyer and advisor, Cryptowala.in, a digital news platform.

The Union Budget 2022 proposed to insert Section 115BBH under the Income-tax Act for charging tax on the transfer of virtual digital assets (VDAs). The rate of tax is proposed at 30 per cent on income earned on the transfer of VDA.