China and Malaysia discuss Asian Monetary Fund

In recent years, a number of Asian countries have shown an interest in distancing themselves from the United States dollar and the International Monetary Fund (IMF), both of which have long had a preponderant position in the international monetary system. One of these nations is Malaysia, and the Malaysian central bank has been collaborating with the People’s Bank of China to facilitate trading in both of their countries’ respective currencies.

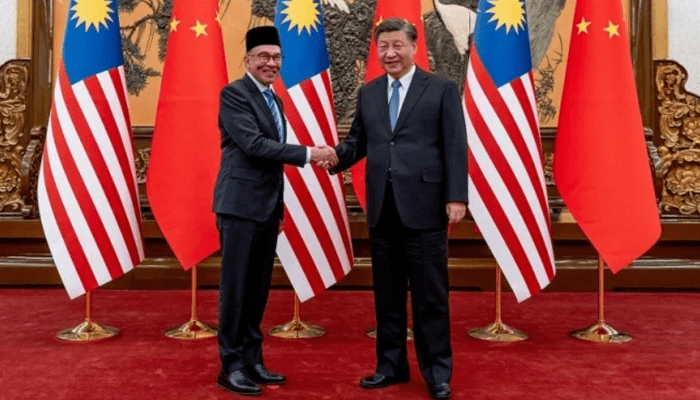

Anwar Ibrahim, the Prime Minister of Malaysia, made the announcement on April 4 that China was willing to consider the possibility of establishing an Asian Monetary Fund. The concept of such a fund was discussed during a meeting that took place the week before in Hainan, which is located in China.

The proposed fund will assist Asian countries in reducing their reliance on the United States currency and the International Monetary Fund (IMF). This action is being seen as a reaction to worries about the economic hegemony of the United States and the dangers connected with the use of the dollar as the reserve currency of the world.

Reportedly welcoming negotiations on the plan, which may pave the way for a more autonomous Asian financial system, China’s President Xi Jinping is said to have shown enthusiasm about the topic. The establishment of an Asian Monetary Fund has the ability to make available financial resources for the region’s infrastructure development projects, therefore fostering economic expansion.

In recent years, there has been a discernible uptick in the momentum around the movement toward a stronger role for Asian currencies in international commerce. In March, China and Brazil reached an agreement to conduct commerce exclusively in their own national currencies, so fully excluding the use of the US Dollar.

The Asian Monetary Fund that is being suggested is not the first effort that has been made to establish a regional financial organization. The Asian Development Bank (ADB) was founded in 1966 with the purpose of fostering economic growth and alleviating poverty across the region. On the other hand, the Asian Development Bank (ADB) has come under fire for being controlled by the United States and Japan and for having a limited effect in tackling the economic difficulties facing the area.

In conclusion, the proposed establishment of an Asian Monetary Fund is a major step forward in the continuing transition away from the predominance of the United States dollar in the international monetary system. Even though the creation of such a fund would be met with a number of obstacles, there is a possibility that it would provide a method of fostering more monetary autonomy and stability across the Asian area.

Article Source

https://blockchain.news/news/china-and-malaysia-discuss-asian-monetary-fund

Other Interesting Articles

Chinese Sports Star’s Gambling Debt Scandal Calls Attention of Authorities Apr 11, 2023

Chinese Sports Star’s Gambling Debt Scandal Calls Attention of Authorities Apr 11, 2023