Total POGO Ban Expected to Reduce Money Laundering Acitivities in PH, Says AMLC

The Anti-Money Laundering Council (AMLC) predicts a decline in money laundering activities following President Ferdinand Marcos Jr.’s total ban on Philippine offshore gaming operators (POGOs). The AMLC stated that POGOs, known for their high vulnerability to money laundering, will no longer be a risk factor once the ban is fully implemented.

The AMLC emphasized that a comprehensive ban on POGOs could substantially lower money laundering opportunities within the gaming sector. “Considering that the POGO sector is highly vulnerable to money laundering activities, a total ban on POGOs may result in a reduction in money laundering opportunities within the gaming sector,” wrote the AMLC in an e-mail sent to Business World.

This follows a 2020 risk assessment which identified POGOs as highly susceptible to such illicit activities.

President Marcos’s directive, issued during his State of the Nation Address in July 2024, mandates the closure of all POGO operations by the end of the year. The ban aims to address various crimes linked to POGOs, including money laundering, prostitution, and human trafficking.

According to Moody’s, the Philippines ranked among the top five Southeast Asian countries experiencing increased money laundering activities from 2018 to 2023. Data showed a 45% increase in money laundering incidents in the country from 2022 to 2023.

Despite the expected reduction in money laundering within the gaming sector, the AMLC noted that the Financial Action Task Force (FATF) has specific concerns unrelated to POGOs. The FATF’s remaining action items focus on mitigating risks associated with casino junket operations, rather than the now-banned POGOs.

The FATF has kept the Philippines on its “gray list” of jurisdictions under increased monitoring for money laundering risks for three consecutive years. While the country has made progress on 15 of 18 recommended actions, it still needs to address issues related to casino junkets. These operations involve arrangements between casinos and junket operators to facilitate high-stakes gambling, including the movement of funds and player services.

The AMLC emphasized that the presence or absence of POGOs does not influence the FATF’s concerns regarding junket operations. To further reduce money laundering risks, the AMLC calls for enhanced anti-money laundering and counter-financing of terrorism (AML/CFT) controls in the gaming sector. This includes rigorous compliance checks and enforcement of anti-money laundering obligations.

Bangko Sentral ng Pilipinas Governor Eli M. Remolona Jr. has indicated that the Philippines could potentially exit the FATF gray list by 2025, provided all remaining action items are addressed.

Read related article: Philippines Aims for FATF Grey List Exit in January 2025

Other Interesting Articles

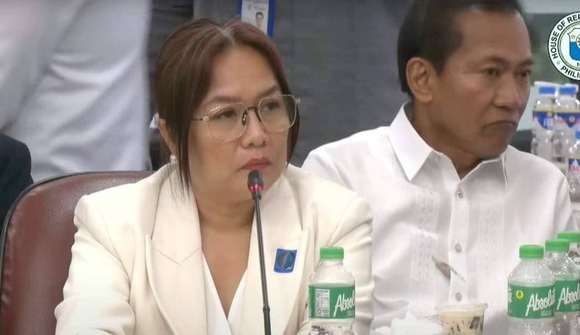

POGO Update: Quad-Committee Issues Subpoena for Harry Roque’s Ex-Aide, AR Dela Serna

POGO Update: Quad-Committee Issues Subpoena for Harry Roque’s Ex-Aide, AR Dela SernaAug 27, 2024