POGO Operators Transferring To These Territories After PH POGO Ban

The impending year-end shutdown of Philippine Offshore Gaming Operators (POGOs) has opened doors for jurisdictions more welcoming to offshore operations. POGO operators who are exiting the Philippines are now turning their sights towards Europe, Vanuatu, and other favorable locations.

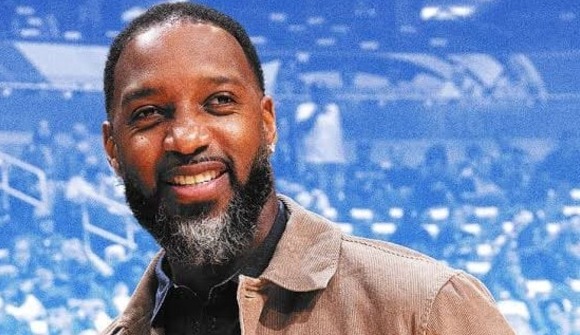

Gaming expert Daniel Li, in an interview with AGB, noted that this moment marks a turning point in the offshore gambling landscape. Operators now face a complicated web of regulatory challenges and legal risks, which will heavily influence their decisions about where to relocate.

He observes that operators aiming to legitimize their businesses within a new regulatory landscape may need to consider relocating beyond the Association of Southeast Asian Nations (ASEAN). Specifically, he suggests: “Relocation outside ASEAN, particularly to more mature European jurisdictions where offshore gaming licenses are well-established, may be necessary.”

According to Li, Europe offers a stable regulatory environment and a clearer legal pathway for these businesses. This stability is a significant draw for operators who have become increasingly wary of the evolving landscape in the Philippines.

In addition to Europe, Li mentioned emerging countries in the Asia-Pacific region, including Timor-Leste, Vanuatu, and Papua New Guinea, as potential relocation destinations. These nations could allow offshore operators to carve out new markets.

“These countries have nascent gaming regulations and, although underdeveloped, offer an opportunity for offshore operators to establish themselves in a new market.”

However, obstacles remain, such as insufficient regulatory agencies, unclear legal structures, and inadequate infrastructure.

“If these countries manage to implement comprehensive regulations, the benefits could be substantial, including increased infrastructure investment, job creation, and enhanced tax revenues from licensing fees, duties, and other levies. However, building the necessary regulatory capacity will be crucial to ensure these benefits are realized,” Li pointed out.

Li warned that while these emerging markets may seem attractive, they also pose considerable risks. “Many ASEAN nations continue to prohibit online gambling,” he cautioned. Relocating to such jurisdictions could result in serious legal repercussions for operators. The risk of regulatory enforcement remains high, especially as governments in the region, including the Philippines, Thailand, and Cambodia, have been tightening controls on offshore gambling operations.

Earlier this month, Philippines Justice Secretary Jesus Crispin Remulla issued a stern warning to Timor-Leste about the potential relocation of offshore gaming businesses to their shores. Reports have also emerged suggesting that countries like Cambodia, Vietnam, and Laos may be the next destinations for POGOs seeking to escape the tightening regulations in the Philippines.

Historically, the Philippines carved out a unique position in the offshore gambling industry. The country’s regulatory framework, particularly the POGO scheme, allowed it to become a regional hub for online gambling. The COVID-19 pandemic further accelerated the growth of this sector, leading to a surge in online gaming activities.

“Until recently, the Philippines was the only country in ASEAN to officially license offshore gambling operations,” Li noted. This regulatory approach attracted legitimate global operators, along with those looking to exploit the system for illegal activities. Consequently, the influx of operators turned the Philippines into a hotspot for online gambling. However, this influx also led to significant regulatory circumvention, prompting the government to reassess its stance on POGOs.

As the government moves to phase out POGOs, the ramifications are becoming increasingly evident. The anticipated exodus of offshore operators is likely to have widespread effects on the local economy. Many of these businesses have been significant contributors to job creation and tax revenues in the Philippines. The ban raises concerns about potential job losses and decreased tax income for the government.

Operators must now reevaluate their business strategies in light of this ban. Some may seek to pivot toward more sustainable models within countries that are better aligned with their operational needs. However, the complexity of regulatory compliance will remain a challenge. The sophisticated nature of many offshore operators has made regulatory enforcement increasingly difficult. “Operators have become more mobile and sophisticated, using advanced technologies to evade detection,” Li explained.

This situation highlights the need for countries to develop comprehensive regulatory frameworks to support legitimate gaming operations. Without strong regulations, the benefits of offshore gaming can be overshadowed by illegal activities and non-compliance, ultimately harming local economies and communities.

The ban on Philippine Offshore Gaming Operators (POGOs), which was announced by President Ferdinand Marcos Jr. in July 2024, created significant upheaval within the gambling sector. This decision, aimed at tightening regulations and enhancing the integrity of the gaming industry, has raised concerns about the future of these businesses and their potential relocation.

The landscape for offshore gambling is shifting dramatically. As the Philippines tightens its grip on POGOs, operators must navigate a precarious path to ensure their survival. While some may look to relocate to more stable jurisdictions, others may attempt to adapt to the evolving regulations in the Philippines.

Read related article: Has the POGO Ban Affected the Attractiveness of PH as an Investment Hub?

Other Interesting Articles

Comelec to File Charges Against Alice Guo for Alleged Misrepresentation

Comelec to File Charges Against Alice Guo for Alleged MisrepresentationOct 23, 2024