Macau Forecasts $29.7 Billion in Gaming Revenue for 2025

The Macau government forecasts 2025 GGR to reach MOP240 billion ($29.7 billion), signaling continued recovery in gaming and tourism.

The Macau government is forecasting a significant resurgence in its gaming industry, with an ambitious target of MOP240 billion ($29.7 billion) in gross gaming revenue (GGR) for 2025. This estimate, part of the recently released 2025 Fiscal Year Budget Proposal, highlights the region’s confidence in its post-pandemic recovery. The projected GGR represents an over 20% increase from 2023’s estimated $24.5 billion, indicating a strong rebound in Macau’s primary economic driver—tourism and gaming.

The proposed fiscal budget for 2025 in Macau projects total revenues of MOP121.09 billion (approximately $15 billion), with anticipated expenditures of MOP113.38 billion ($14.1 billion), resulting in a projected surplus of MOP7.7 billion ($954 million).

As of October 2024, Macau’s casino gross gaming revenue (GGR) has reached MOP190.1 billion ($23.7 billion), marking a 28.1% increase compared to the same period in 2023. However, this figure still lags 23% behind the GGR for the same months in 2019, when it stood at MOP246.9 billion ($30.8 billion).

There is a projected rise of 13% from the initial budget for 2024, according to the news outlet Macau Business. Gaming taxes and profits taxes are expected to contribute MOP84 billion ($10.4 billion) and MOP6.83 billion ($852.5 million), respectively.

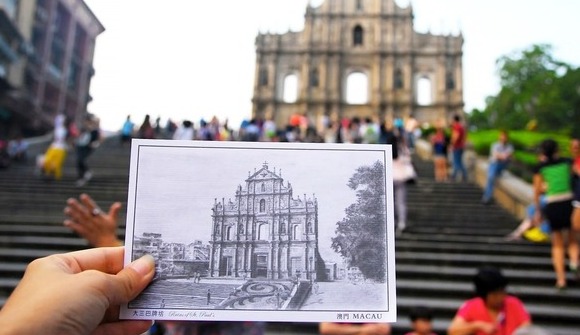

Macau’s recovery is underpinned by a surge in international travel, relaxation of COVID-19 restrictions, and robust infrastructure improvements aimed at attracting a diversified pool of visitors. The SAR’s strategic focus is now on broadening its economic base, including initiatives to develop non-gaming attractions like integrated resorts, family-friendly entertainment, and convention centers.

READ: Macau Sees 17% Decline in Non-Gaming Visitor Spending During First 9 Months of 2024

With a consolidated revenue target of $15 billion, the Macau government’s financial plan for 2025 shows a strong belief in economic recovery. Both the gaming and non-gaming industries are driving this forecast, indicating efforts to diversify outside of the conventional casino sector. In addition, the government anticipates a budget surplus of around $1 billion, demonstrating fiscal stability following years of economic difficulties brought on by the pandemic. These projections highlight Macau’s strategic focus on boosting infrastructure, reviving tourism, and lowering reliance on gambling in order to achieve sustainable growth.

Despite the government’s optimistic forecast, financial analysts like those from Bank of America have provided slightly lower estimates of around $28.5 billion for 2025. This caution is due to uncertainties related to regulatory changes, such as the potential impact of China’s tightened oversight on money flows and currency exchanges. These regulations could affect the VIP gaming segment, traditionally a substantial revenue contributor for Macau.

Macau’s tourism recovery has been notable, with the number of visitors expected to reach pre-pandemic levels by mid-2025. Analysts anticipate over 35 million visitors next year, buoyed by increased flights, relaxed visa requirements, and promotions targeting mainland Chinese tourists. The mass-market gaming sector, which includes slot machines and lower-stakes table games, is expected to outperform the VIP segment, accounting for approximately 65% of the total GGR. This shift reflects changing consumer behavior and the government’s push for a more stable and diverse gaming revenue stream.

As part of its long-term economic strategy, Macau is diversifying into non-gaming sectors. Recent investments in tourism infrastructure include a $1.5 billion upgrade to its airport, expanding its capacity to accommodate the growing influx of visitors. The government is also promoting large-scale conventions, entertainment events, and shopping festivals to increase Macau’s appeal as a global leisure destination beyond casinos.

This balanced approach aims to reduce the city’s reliance on gaming revenue, which historically accounted for more than 80% of its total income. By integrating non-gaming attractions, Macau hopes to attract families and younger demographics, tapping into new markets for sustained growth.

Read related article: Macau GGR Sets New Post-Pandemic Record at US$2.6 Billion in October 2024

Other Interesting Articles

No Police, Politician Helped Alice Guo Escape – Senator Nov 14, 2024

No Police, Politician Helped Alice Guo Escape – Senator Nov 14, 2024