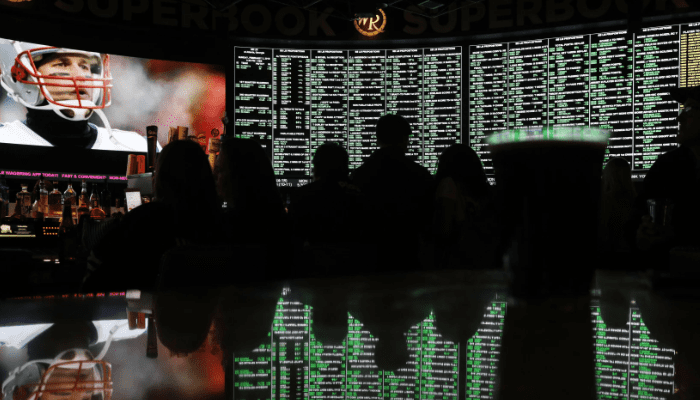

What Impact Does the Economy Currently Have on Betting Behavior?

In what may be considered a gloomy market, Declan Raines, Head of US Gaming at TransUnion, looks at how the economy is affecting sports betting in the US.

Consumer spending has been greatly influenced over the past year by record inflation, rising interest rates, and a probable recession. The economy is contracting despite falling gas costs and signs of lowering inflation. How has persistent inflation affected disposable income, and what does this signify for the sports betting sector?

Both consumers and players are under intense financial strain as we start the second quarter of 2023. According to a recent survey, the majority of Americans acknowledged that inflation has an effect on their daily spending and expressed concern about how it will affect their financial security and capacity to pay their expenses in the coming year.

But unlike prior recessions, we haven’t had the associated increases in unemployment that come along with inflation. We are currently going through a black swan event that involves a record-breaking job market and inflation. There are many worries about a recession right now, but neither the property nor employment markets are showing signs of it – there are still plenty of jobs available, and wages are rising.

Sports betting businesses that rely on discretionary spending may be wondering what the immediate future holds for them in this unusual position.

Effects associated with gambling

Traditionally, we picture cutting back on eating out, taking fewer trips, and streaming services when we think of a decline in discretionary spending. persons might not take into account the number of persons who abstain from gambling.

“Concerns about a recession are already widespread, but we’re not seeing that translate to the housing or job markets – many positions are still available and salaries are increasing. We’re having a black swan event – a once-in-a-generation job market with record-high inflation.”

The worldwide sports betting market is anticipated to reach $144 billion by 2026, but it will confront difficulties due to an unsteady economic outlook in 2019. Nearly half of bettors had cut back on discretionary spending as of 2022. Discretionary spending will fall much further if the strong labor situation starts to deteriorate and inflation stays high.

There is a belief that gambling and sports betting are recession-proof. This is not totally true, as we’ve discovered. Casino business may stall during a recession, although sales of lottery tickets may rise. Different forms of gambling products appear to be affected differently. Consumers betting on mobile sports decreased from 19% in the second quarter to 11% in the fourth quarter as economic inflation increased toward the second half of 2022.

In every market, but particularly in sports betting, consumer liquidity and financial stability are crucial.

What we discovered

We can see how the decline in consumer liquidity translates into a decline in discretionary spending in Transunion’s Q1 2023 Consumer Pulse: Online Sports Betting Study. Despite the fact that prices are still high, inflation is declining, but the consumer price index is lagging behind; in December, it increased by 6.5%.

As a result of inflation, 79% of our survey’s sports bettors and 72% of non-sports bettors are altering their purchasing habits. In 2023, discretionary consumer expenditure is anticipated to stagnate. In Q4, income growth slowed, which probably contributed to the decline in spending.

Operators must improve their responsible gaming strategies to recognize risky behavior in order to reduce this risk. Additionally, this should apply to their marketing plans, which should center on attracting more resilient customers who are resistant to macroeconomic conditions and moving away from acquisition to retention goals.

High-value bettors, mobile sports bettors, and non-sports bettors were the three categories into which the respondents were split. Compared to mobile and non-sports gamblers, high-value bettors had greater income levels, were more upbeat about their future financial situation, and spent more on discretionary items. High-value sports bettors also appear to be in more hardship, since they are using more of their retirement assets and available credit.

Furthermore, a large portion of those polled already believed that the economy was in a recession, which may have (surprise) biased their outlooks in a positive direction because it implies that things can only get better.

Surviving the turbulence

Betting operators must begin preparing methods to decrease the impact on their profitability in order to survive downturns.

As more individuals experience financial difficulties and income falls over the next six to twelve months, the risk associated with responsible gaming is anticipated to rise. As some gamblers do so to supplement their income, this suggests that problem gambling will become more prevalent. Operators must improve their responsible gaming tactics to recognize dangerous behavior in order to reduce this risk. This should also be true of their marketing tactics, which should put more emphasis on finding customers that are resistant to macroeconomic fluctuations and moving away from acquisition to retention goals.

Sometimes it can be challenging to distinguish between risky and resilient consumers. We must locate that line immediately. Operators must recognize financial challenges among specific population segments if we notice them in order to prevent harm to people.

In particular in more established state markets like New Jersey, sportsbooks are likely to change their focus from customer acquisition to customer retention. As the economy changes, concentrating your marketing efforts on bonuses and luring new customers may wind up costing you more money than those same gamers are willing to contribute.

There is a belief that gambling and sports betting are recession-proof, but we have discovered that this is not totally true. For example, casino revenue may stagnate during a downturn, but lottery ticket sales may rise.

Marketing aggressively makes less sense when a customer’s liquidity is low. Due to the quantity of marketing and advertising required, keeping existing clients is more cost-effective than finding new ones. Platforms should prioritize loyalty programs and the player experience instead.

Moving forward

Companies must constantly monitor their customer base because discretionary expenditure and economic conditions both affect liquidity. In a recession, the ability to adapt marketing techniques to the demands of customers and target the right consumer base could spell the difference between success and failure.

Sportsbook operators need to be more aware of the industry than ever as we move towards the second quarter of 2023. Because their loyal, high-value bettors will be able to weather any economic crisis, operators must prioritize them in light of growing concerns that another recession could occur at any moment this year.

Other Interesting Articles

PAGCOR Offices and Gaming Venues Achieve ISO 9001:2015 Certification

PAGCOR Offices and Gaming Venues Achieve ISO 9001:2015 CertificationApr 14, 2023