Bitcoin Rises With Other Risk Assets. Thank The Fed.

BitcoinBTCUSD +1.24% and other cryptocurrencies rose Wednesday along with other risk assets after the Federal Reserve hiked rates by a quarter point.

It’s another rate hike, but a marked slowdown in the pace of tightening financial conditions after a spate of much larger increases last year. The Fed also reiterated its projection that it would raise rates at least twice more.

Markets rose during Fed Chair Jerome Powell’s question-and-answer session with reporters, in which he noted that inflation so far has come down quickly and that the decision to hike rates further would depend on incoming economic data.

The price of Bitcoin has risen about 1.5% over the past 24 hours, hovering around $23,400. The largest digital asset has roared higher to start the year, gaining 40% as cryptos benefited from an improvement in investors’ appetite for risk. While Bitcoin remains at just a third of its late-2021 high, traders are increasingly optimistic that the bottom of a brutal bear market already has been hit—in the wake of the shock bankruptcy of FTX in November—and that cryptos are poised to march higher.

“Crypto fundamentals are taking a backseat here and the primary driver is what the overall appetite is for risky assets,” said Edward Moya, an analyst at broker Oanda. “Bitcoin appears to have massive resistance at the $24,000 level, so if the rally stalls after the Fed and mega-cap tech earnings fireworks, a consolidation back towards $20,000 could happen.”

Indeed, earnings Wednesday from Meta Platforms (ticker: META)—and peers Apple AAPL +0.79% (AAPL), Alphabet (GOOGL), and Amazon.com (AMZN) on Thursday—will hit sentiment for tech, likely leaking over to cryptos.

But the spotlight is on the Fed. Decades-high inflation and rising interest rates have been a key headwind for Bitcoin over the past year, with cryptos becoming more correlated with stocks against a macro backdrop that is unfavorable to risk-sensitive assets. Investors are hoping that the worst is over.

In its statement accompanying the rate rise, the Fed kept language stating that it anticipated “ongoing increases” in the target range for the Federal funds rate. The statement removed some language suggesting that the Covid pandemic and events in Ukraine were contributing to inflationary pressure.

Crucially, during his remarks to reporters, Powell said he believed the markets already reflected significantly tighter financial conditions. He attributed markets’ rate expectations, which are more dovish than those of Fed officials, to investors’ rosier view on how fast inflation could come down.

For digital tokens and other risk assets, that added up to a substantial rally as Powell spoke. Beyond Bitcoin, Ether—the second largest crypto—was up nearly 2% in the past 24 hours to $1,619.50. Smaller tokens Cardano and Polygon rose 5% and 10% respectively after the Fed’s release, after previously being down on the day.

The recent rally in cryptos looks largely to be built on sand, with Bitcoin’s eye-popping jumps fueled by low liquidity and technical factors including a short squeeze pushing prices higher—not organic demand. Those same trends that have helped boost prices could accelerate a deep selloff.

Source: https://www.barrons.com/articles/bitcoin-ethereum-price-crypto-markets-today-51675247637

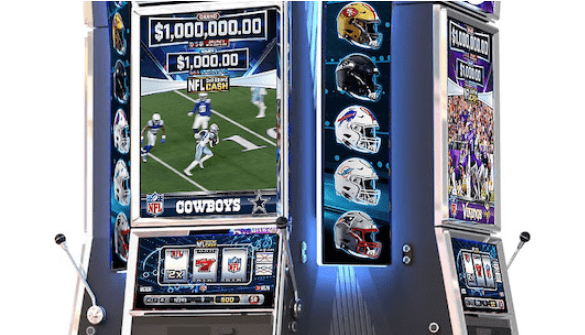

Other Interesting: How Do Online Casinos Make Money?

See other website: Oriental Game

Other Interesting Articles

How Do Online Casinos Make Money?

How Do Online Casinos Make Money?Feb 1, 2023