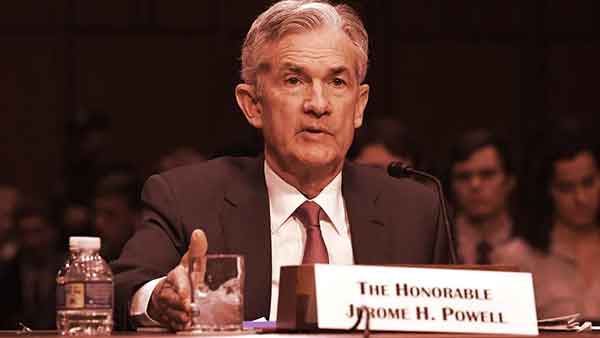

Bitcoin, Ethereum and Stocks Jump Following Fed’s Fourth Rate Hike

The Federal Reserve announced today that it will continue with its aggressive monetary policy to fight inflation, and both crypto and traditional markets are so far reacting positively to the news.

Bitcoin, the largest cryptocurrency by market cap, was trading at $20,650 at the time of writing, according to CoinGecko data, a modest 1% 24-hour increase.

While Ethereum, the second-biggest cryptocurrency by market cap, was up 1.3%, priced at around $1,600.

On news of the Fed’s announcement, stocks also climbed. Wall Street trading was yesterday shaky on news that the labor market was strong and the Fed would therefore continue to raise interest rates.

The Federal Reserve today hiked interest rates by 75 basis points for the fourth consecutive time this year to combat inflation—currently at a 40-year high in the U.S.

Although the Fed’s aggressive monetary policy has led investors to go to safe-havens like the U.S. dollar—which has seen its value soar—it is expected the central bank may slow down the pace of its tightening soon, positive news which may have prevented a sell-off today.

“In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments,” today’s statement from the Fed said.

The Bank of America said in a Wednesday report that it expects “the Chair to open the door to a slower pace of hikes beginning in December.”

Along with inflation, Russia’s invasion of Ukraine and Europe’s energy crisis has also led investors around the world to sell their stakes in equities. An aggressive Fed policy could hurt the crypto sphere, experts told Decrypt.

OANDA senior market analyst for the Americas Edward Moya told Decrypt: “Digital assets are going to struggle here if the Fed stays hawkish with fighting inflation.”

“The economy is not weakening quickly enough to warrant a downshift with tightening and that could weigh on cryptos,” he added. “Bitcoin’s correlation with U.S. stocks remains intact and probably will continue until inflation significantly declines,” Moya said.

Bitcoin and Ethereum are still up 2.1% and 8.4% respectively in the past seven days. And Dogecoin, the original “meme coin” pumped by Elon Musk, is an outlier in the digital space: the coin is up 106% in the past week since the world’s richest man bought Twitter.

Source:https://decrypt.co/113389/bitcoin-ethereum-stocks-fed-fourth-rate-hike

Other Interesting Articles: https://asiacasino.org/2022/11/02/some-roulette-crypto-casino-options-you-may-try/

See other website: Oriental Game

Other Interesting Articles

Thailand Cracks Down on Illegal Online Gambling Websites Sep 20, 2022

Thailand Cracks Down on Illegal Online Gambling Websites Sep 20, 2022