Wynn Resorts Abandons Online Gambling SPAC. Should Investors Worry?

It’s been a wild week for entertainment stock Wynn Resorts (NASDAQ:WYNN), the high-end casino company with operations in Las Vegas, Boston, and Macao. Wynn reported third-quarter earnings that were decent but not impressive, the CEO announced he was leaving, and on Friday morning the bombshell dropped that Wynn is no longer spinning off its online gambling business to a SPAC.

These moves aren’t necessarily surprising. Outgoing CEO Matt Maddox has been through arguably the most difficult tenure a gambling CEO has ever seen. And on the online gambling side, Wynn is a small player that needs a different strategy than bigger rivals. Here’s a look at what’s happening and how to look at it as investors.

A gambling business update

It’s worth taking a look at what operating results looked like in the third quarter. Revenue was $994.6 million, up from $370.5 million a year ago in the middle of the pandemic. Adjusted property EBITDA, which is a proxy for cash flow from resorts, was $154.6 million, which was driven almost entirely by Las Vegas.

Not surprisingly, Las Vegas performed well, with $476 million in revenue and $183.4 million in EBITDA. If those results continue, 2022 could be the most profitable year on record for Wynn Las Vegas. And Boston results were decent, with revenue of $192.2 million and EBITDA of $64.6 million.

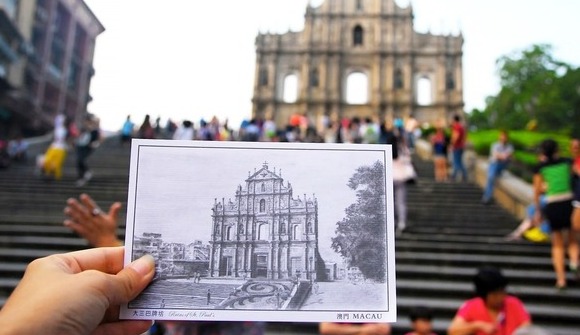

It’s Macao that was down, with Wynn Palace revenue of $181.3 million and adjusted EBITDA of just $12.1 million. Wynn Macau generated $130.7 million in revenue and had a negative $1.9 million in property EBITDA.

Las Vegas is thriving, Boston Harbor is improving, and Macao continues to be a drag. None of this is surprising given industry trends. The big wild card is that if Macao recovers, it could be a cash flow machine — but we’re not there yet, and we don’t know how long a Macao recovery will take.